The following analysis shows how allocations to bonds helped limit downside in the last two equity bear markets.

A cursory glance at current yields highlights that those benefits are no longer available.

Floored Yields

Holding U.S. Treasuries maturing in ten years or less is likely to provide no price appreciation if yields fall to their record lows. If that’s the case, and given such low yields, those bonds are essentially cash surrogates with outsized risks.

The question for those bondholders is, why hold such bonds? Given the yields are not much above cash yields, they must believe rates can drop to new records. If they did not think that, why not just hold cash?

There are likely two factors that would lead to lower rates for the full maturity spectrum of Treasury yields.

- Deflation kicks in, boosting real yields, which entices investors to buy bonds.

- The Fed shows intent to reduce Fed Funds into negative territory.

Deflation?

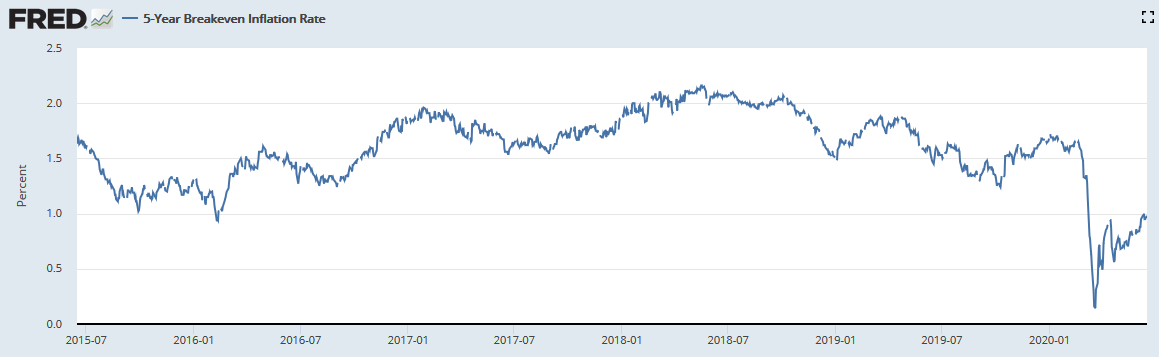

Currently, inflation expectations are reduced from prior-year levels but are ticking up gradually and still well above zero. It is reasonable expectations fall if the recovery proves elusive.

Contrary, the Fed seems more than willing to push unlimited amounts of monetary stimulus until inflation is running hot. That potentially raises other problems. As the saying goes, “you can’t put a saddle on a mustang.”

Negative Rates?

Most Fed speakers, including Jerome Powell, have come out against negative rates. They seem to have noticed that such policy has damaged European and Japanese banks. The banks own the Fed, and therefore it’s reasonable to assume they will not repeat the mistakes by the other central banks.

“There’s no clear finding that it (negative rates) actually does support economic activity on net, and it introduces distortions into the financial system, which I think offset that,” Powell said. “There’re plenty of people who think negative interest rates are a good policy. But we don’t really think so at the Federal Reserve.”-Jerome Powell on 60 Minutes 5/18/2020

We certainly do not rule out negative rates but believe QE is the Fed’s preferred option.

Hedging with Bonds

While the inflation outlook and the Fed’s perspective can change, it appears yields may be at a floor. Based on the table, 30-year Treasury bonds can provide a 10% return if they decline to record low yields. Every other maturity, assuming the floor holds, will deliver cash-like returns in a best-case scenario.

Portfolio managers are in quite a quandary. Will they consider Treasury notes with meager yields and little upside an equity hedge? Are they willing to hold higher duration price-sensitive bonds with limited upside as a hedge?

The benefits of hedging with bonds have certainly changed from years past. It seems unlikely that a 40% allocation of bonds can provide 20-25% downside protection, as was the case in the prior two recessions.

Other Bond Asset Classes

Investment-grade corporate bonds and mortgage-backed securities may also offset equity exposure. The benefit versus Treasuries is they provide a little more yield. The cost for the higher yield are additional risks. Credit spreads on such instruments have a habit of rising at the most inopportune times.

The Fed is actively buying those sectors and not allowing risk to be priced correctly. Accordingly, those risks are minimal for now. Use caution, however, the risk is higher for individual securities versus funds and ETFs representing those sectors.

Corporate and mortgage bonds offer some additional upside if their respective spreads return to their record lows. For reasons described above, that incremental benefit is limited though.